Frequently Asked Questions

-

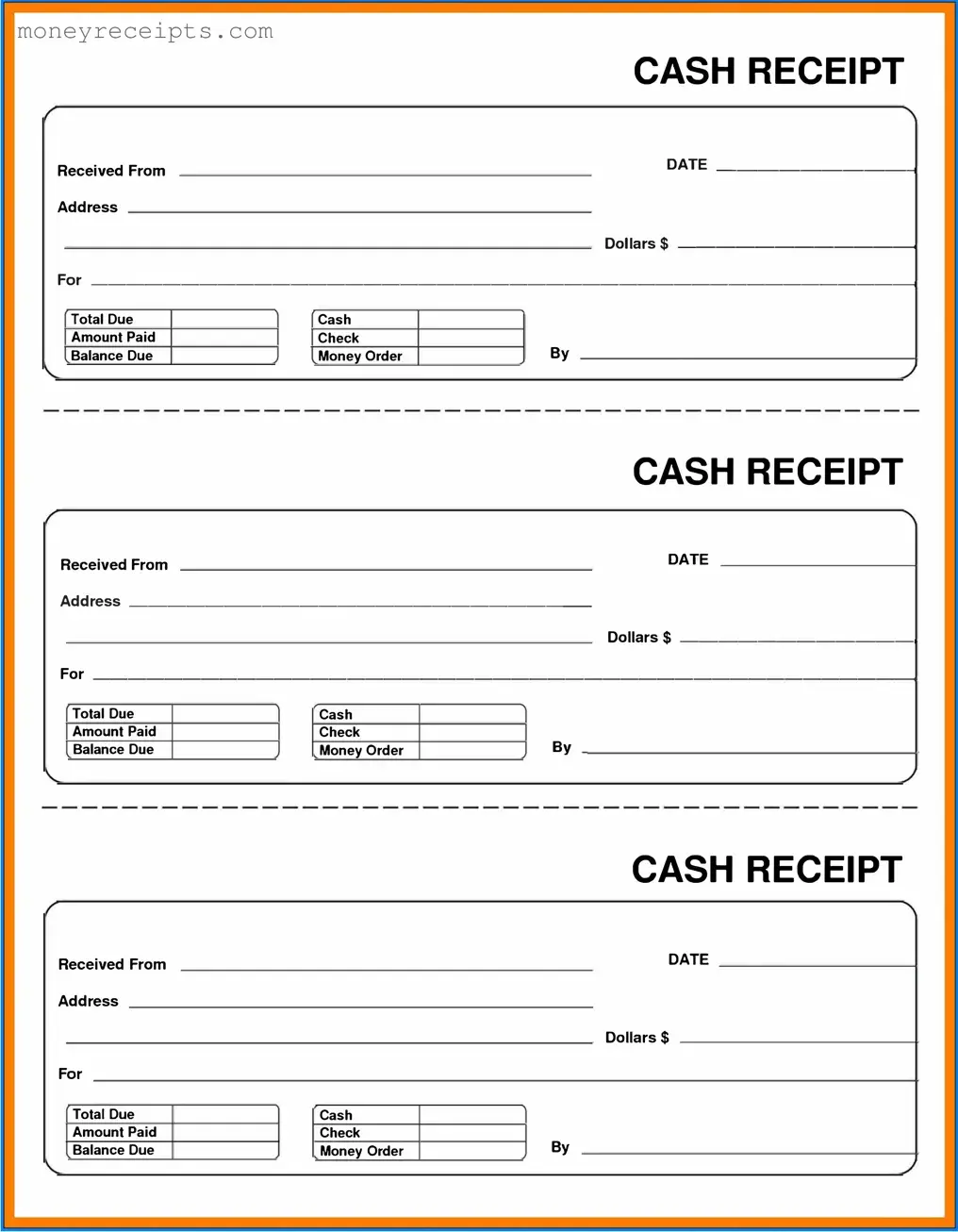

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of payment for both the payer and the payee. This form is essential for maintaining accurate financial records and is commonly used in various transactions, including sales, services, and donations.

-

Why is a Cash Receipt form important?

This form plays a critical role in financial accountability. It helps businesses and organizations track incoming cash flow, provides evidence of transactions, and supports accurate bookkeeping. Additionally, it can be useful for auditing purposes and for resolving any disputes that may arise regarding payments.

-

What information is typically included in a Cash Receipt form?

A standard Cash Receipt form usually includes:

- Date of the transaction

- Name of the payer

- Amount received

- Payment method (cash, check, credit card, etc.)

- Description of the transaction

- Signature of the person receiving the payment

Having all this information documented helps ensure clarity and accuracy in financial records.

-

Who should use a Cash Receipt form?

Any individual or organization that receives cash payments can benefit from using a Cash Receipt form. This includes businesses, non-profits, freelancers, and even individuals conducting personal transactions. It’s a straightforward way to keep track of cash inflows.

-

Can a Cash Receipt form be used for transactions other than cash?

Yes, while the name suggests it is for cash transactions, a Cash Receipt form can also be adapted for other payment methods, such as checks or credit card payments. It is important to specify the payment method used to maintain accurate records.

-

How should I store Cash Receipt forms?

It’s best to store Cash Receipt forms in a secure and organized manner. Digital copies can be saved in a secure cloud storage system, while physical copies should be kept in a locked filing cabinet. Ensure that these records are easily accessible for future reference, audits, or any potential disputes.

-

How long should I keep Cash Receipt forms?

Generally, it is advisable to keep Cash Receipt forms for at least three to seven years, depending on your local laws and regulations. This timeframe allows for sufficient time to address any questions or audits related to your financial transactions.

-

Can I create my own Cash Receipt form?

Absolutely! Many businesses and individuals create their own Cash Receipt forms tailored to their specific needs. Just ensure that your form includes all the necessary information to maintain clear and accurate records. There are also templates available online that can serve as a starting point.

-

What should I do if I lose a Cash Receipt form?

If a Cash Receipt form is lost, it’s important to document the transaction as thoroughly as possible. You may want to recreate the form with all relevant details, including the date, amount, and nature of the transaction. If applicable, communicate with the payer to confirm the transaction details and maintain transparency.